- The number of over 65s searching for rooms in flats and house shares or seeking housemates has risen elevenfold in 10 years; the number of over 55s has tripled.

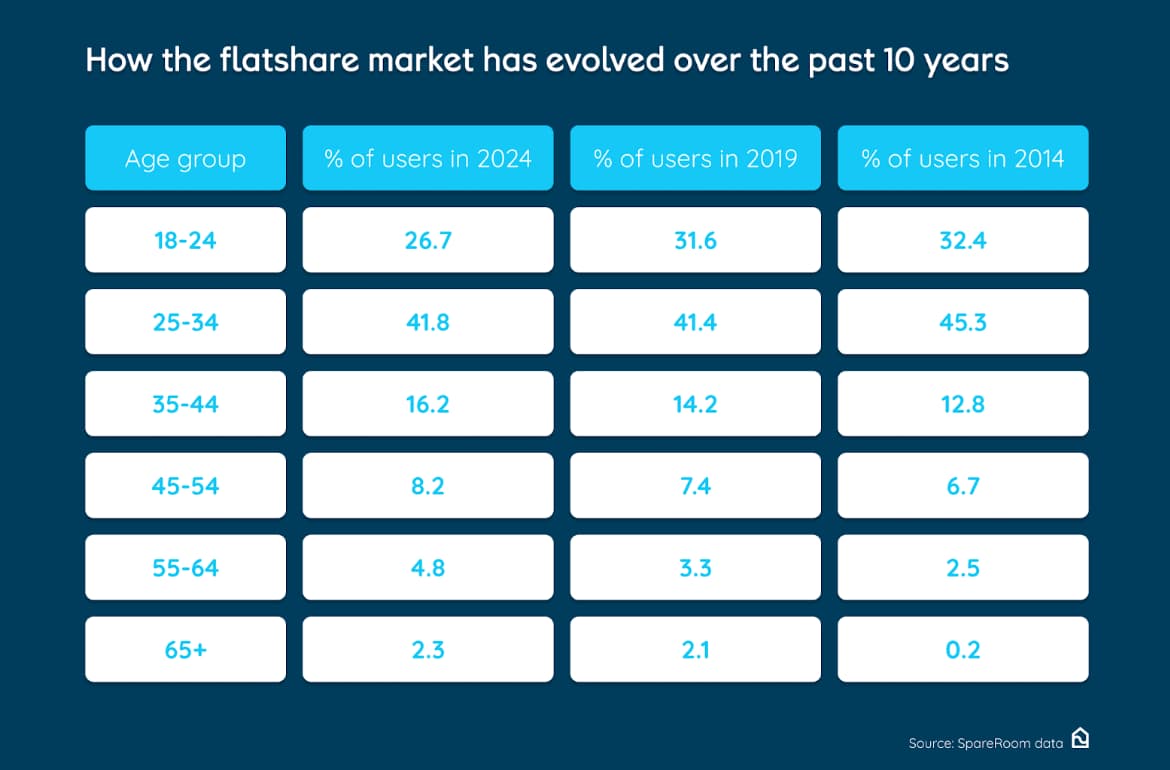

- Young would-be flatsharers are flying the nest later: 18-24 year olds made up almost a third (32%) of the room rental market in 2014 - now it's only 27%.

- In the past two years there has been a 73% rise in the number of over 65s renting out spare rooms to lodgers as people look for ways to boost retirement incomes.

Those in their late 20s and early 30s still dominate the flatshare market, but older age groups are the fastest-growing demographics looking for housemates and rooms to rent in shared homes. That's according to new data from flatshare site SpareRoom.

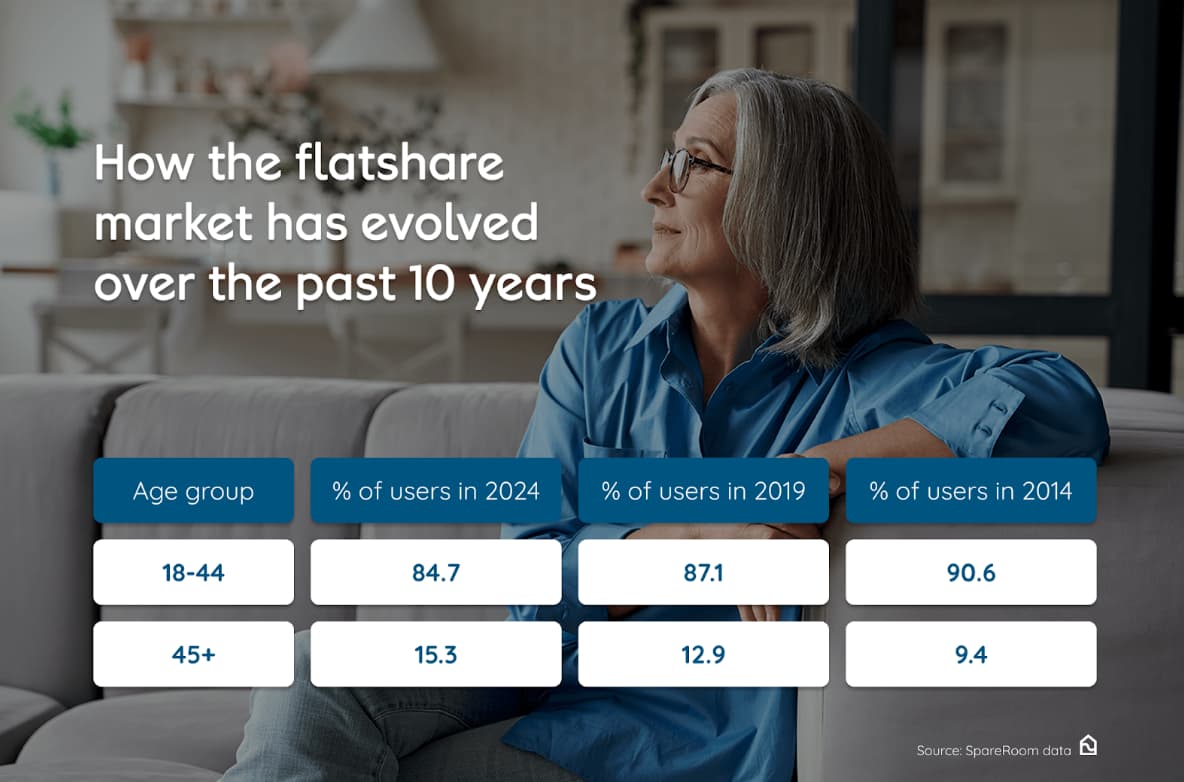

Over the past decade, the number of over 65s searching for rooms in flat and house shares, or seeking housemates, has risen by 970% and the number of over 55s by 189%.

At the same time, younger flatsharers are dwindling. In 2014, 18-24 year olds made up almost a third (32%) of the room rental market - a figure that, by 2024, had dropped to just over a quarter (27%).

There has also been a small decrease in what has long been the biggest demographic in the flatshare market: 25-34 year olds. In 2014, this group made up 45% of the market, and a decade later it's 42%.

The mean age of UK first-time buyers is 34-years-old, but the number of flatsharers aged 35-44 has increased steadily over the past decade - yet more evidence that homeownership is increasingly out of reach. This group made up 13% of the flatshare market in 2014, by 2019 this figure had grown to 14%, and to 16% by 2024.

Meanwhile, the numbers of older homeowners taking in lodgers is increasing. In the past two years there has been a 73% rise in the number of over 65s renting out empty bedrooms in their homes, earning on average £993 per month in London or £661 per month in the rest of the UK - £7,500 per year of which is tax-free under the Rent a Room scheme.

One report found the UK pension shortfall is now £31,546, with rising inflation and the cost of living crisis to blame. As such, only around a third of households are on track for a 'moderate' income in retirement.

The table below shows how the flatshare market has evolved over the past 10 years:

Matt Hutchinson, director of flatshare site SpareRoom, comments:“This is no flash in the pan. The rising cost of living has left people with less money each month to divert into retirement savings which is why we're expecting to see the numbers of mature flatsharers continue to climb.

“For younger people, the transition from renting to buying is no longer a milestone that feels remotely achievable, and inflationary pressures on the rental market make it harder to access, as well as harder to leave. More are living with their parents for longer.

“We have to make common-sense changes to the private rented sector now, to make renting at any age - and for life - an affordable and viable option in the UK. It's really encouraging to see that more homeowners are renting rooms to lodgers. Making better use of existing housing stock and offering more generous tax incentives under the Rent a Room scheme is crucial to boosting rental supply and increasing affordability across the rental sector. So too is incentivising landlords to stay in the rental market, provided they are renting to tenants and not offering short-term holiday lets.”