- One in seven (14%) flatsharers don't think they'll ever get on the property ladder and three in 10 (30%) are unsure.

- The rent burden is intensifying: 26% of flatsharers now spend more than 50% of their take-home pay on rent while three quarters spend more than 30%.

- The top reason people want to buy property is an emotional one: 'having somewhere to call home' (70%) comes just ahead of financial factors.

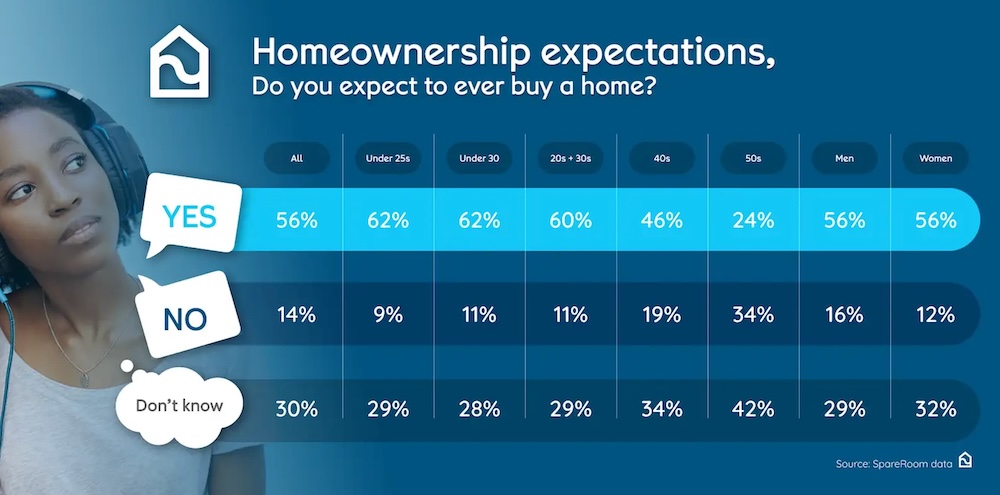

A new survey of 6,524 renters by flatshare site SpareRoom reveals expectations around homeownership and, while 56% believe they will be able to buy property at some point, 14% don't think they'll ever get on the property ladder, and 30% are unsure.

Of those who don't think they'll ever be able to afford to buy, almost two thirds (65%) said they are unable to save a deposit, while a similar proportion (67%) said they don't earn enough to qualify for a mortgage. Almost half (48%) said their family couldn't help them with a deposit. However, more than one in 10 (11%) said they simply prefer renting.

Around a third of renters (34%) would be happy to rent long term if there wasn't the pressure to buy - a figure that has dropped from 55% in 2021. Clearly, home is where the heart is, as the biggest influencing factor for wanting to buy is 'having somewhere to call home' (69.7%), slightly ahead of 'having long-term financial security' (68.6%) and 'paying into something I own rather than to a landlord' (68%).

Gen Z is optimistic

In the survey, which was carried out before the second interest rate cut this year, the 2,920 respondents who were under 30 - and therefore mostly Gen Z - appeared optimistic about homeownership.

More than six in 10 (62%) under 30s expect to buy property at some point, and 38% expect to do so within the next five years. However, 40% believe it will take them five to nine years, and 16% say it will take 10-15 years. But how will they do it?

- 92% will use savings

- 47% will team up with their partner

- 27% will get financial help from family or friends

- 17% will use inheritance

- 9% will team up with a sibling or parent

- 6% will team up with a friend

A quarter (25%) of renters under 30 are considering moving back in with their parents to save money while another 27% said they aren't considering this now, but might in the future.

More than half (51%) of under 30s are resigned to having to relocate to be able to afford to buy. And 86% are cutting down on their expenditure to save towards home ownership. The top three sacrifices are eating out (63%), holidays/weekends away (56%), and buying clothes (55%).

But homeownership expectations decrease dramatically as renters get older, dropping to 24% as renters enter their 50s, as shown in the table below:

| Q. Do you expect to ever buy a home? | All | Under 25s | Under 30 | 20s + 30s | 40s | 50s | Men | Women |

|---|---|---|---|---|---|---|---|---|

| Yes | 56% | 62% | 62% | 60% | 46% | 24% | 56% | 56% |

| No | 14% | 9% | 11% | 11% | 19% | 34% | 16% | 12% |

| Don't know | 30% | 29% | 28% | 29% | 34% | 42% | 29% | 32% |

Meanwhile, the rent burden is intensifying. Renters spending more than half their take-home pay on rent has increased from 24% in 2021 to 26% in 2025. In that time, UK average room rents have increased by 29% from £576 per month in Q1 2021 to £744 per month in Q1 2025. Under 25s, who have not yet reached their earning potential, are feeling the pinch most, with 40% spending more than half their take-home pay on rent.

The rent burden on women is also significantly heavier than on men, likely due to factors that include the gender pay gap, and the want to live in safer areas where rents may be higher.

| Q. What % of monthly take-home pay is spent on rent? | All | Under 25s | Under 30 | 20s + 30s | 40s | 50s | Men | Women |

|---|---|---|---|---|---|---|---|---|

| Less than 30% | 25% | 17% | 22% | 24% | 28% | 30% | 31% | 21% |

| More than 30% | 75% | 83% | 79% | 76% | 72% | 70% | 69% | 79% |

| More than 50% | 26% | 40% | 29% | 26% | 25% | 27% | 20% | 31% |

Matt Hutchinson, director of flatshare site SpareRoom, comments: “The post-pandemic rush for rentals forced rents to record highs across the UK. However, as is all too often the case, despite the market cooling, rents never came back down again. Affordability was already a huge issue before the pandemic, but people have become increasingly rent burdened and are faced with tough choices: do they compromise where they live, and the quality of the home they live in, to save towards a deposit?

“Under 30s seem optimistic about their chances of eventually owning homes. But the plummeting home-owning expectations of renters now in their 40s and 50s, coupled with the high cost of living, makes you wonder if the expectations and the reality are aligned.

“The number of over 65s searching for rooms in flatshares or seeking housemates has risen elevenfold in 10 years, while the number of over 55s has tripled according to our data, and the decline of homeownership is well documented. The real question we have to start asking is what happens to a generation who retire without having built an asset through homeownership and who clearly haven't been able to save either? This is a ticking time bomb that'll one day blast a huge hole in the public purse if it's not addressed now. It's time for some proper long-term policies.”