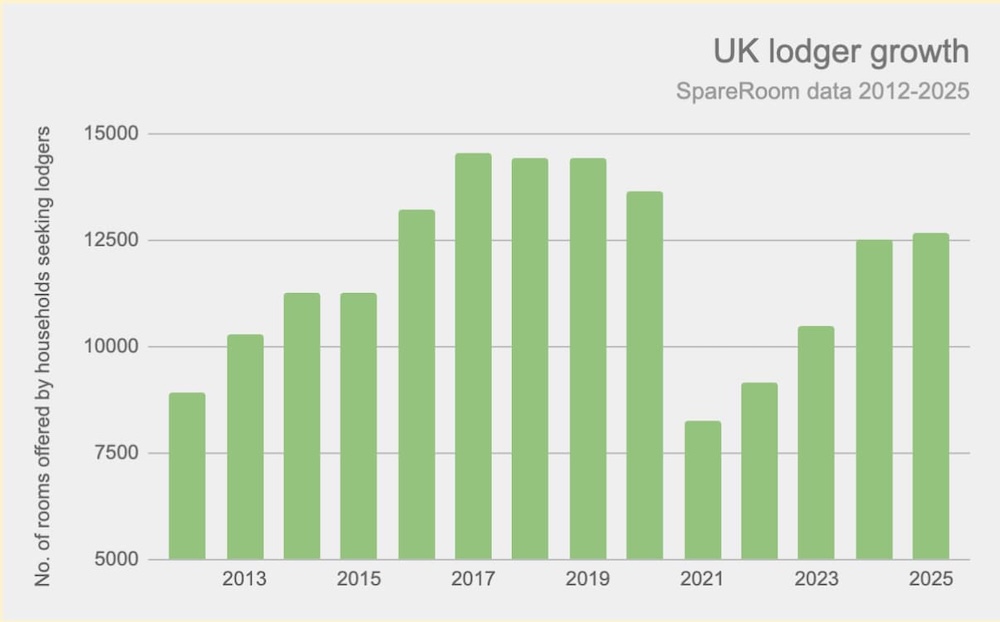

- Households renting out rooms to lodgers have long buoyed supply in the UK rental market and kept average rents down, but the number of rooms available to lodgers only rose 1.5% in the past year, down from 19% growth the previous year1.

- In the midst of a housing crisis, SpareRoom warns “a shot in the arm” is needed to return supply growth to levels seen from 2016 when the Rent a Room scheme threshold was last increased.

- Improve tax relief to incentivise more under-occupied households to rent rooms to lodgers and close the loophole that allows holiday lets to use the scheme to inject supply.

Growth in the number of households offering rooms to lodgers has slowed significantly in the past year, despite the high cost of living stretching household budgets, reports flatshare site SpareRoom.

Between 2024 and 2025, growth was subdued at 1.5%, down from a 19% increase between 2023 and 20241.

A quarter (25%) of all rooms available to rent in shared accommodation are offered by lodger landlords, who help keep rent inflation down by contributing to supply and offering cheaper rents that are 13% lower on average.

Over the past five years, the UK average room rent has risen 28% and, in Q3 2025, hit a new high of £753 per month2. But the Rent a Room scheme threshold - the amount people can earn tax-free from renting out furnished rooms in their homes - has not changed since 2016 when monthly rents were £573, and well within the threshold.

Today, household earnings could be boosted by an average £9,036 a year from renting out one room2. Of this income, £7,500 per year - or £625 per month - is tax free. But almost six in 10 (58%) UK postcode districts now have average rents higher than £625 per month3. In short, today's higher rents push more households earning income from lodgers into tax, creating a barrier to entry.

In July 2025, SpareRoom surveyed 1,582 former lodger landlords and people who had expressed an interest in becoming lodger landlords but who weren't currently renting out rooms. A majority (83%) said they would be more likely to rent out a room if the tax-free threshold was increased and 40% said they'd stopped renting out a room because their earnings would take them over the tax-free limit and they would have to complete a tax return.

Keeping the scheme threshold in line with average rents benefits more than just homeowners. The graph above shows UK households seeking lodgers peaked at record levels after the last Rent a Room scheme threshold increase in April 2016. Numbers were later depleted by the pandemic and although they have been on an upward trajectory since lockdowns ended, the numbers haven't fully recovered and, in the past year, growth has been unusually low.

Another pressing problem is that, due to a loophole that has never been closed, the tax relief also applies to short-term holiday lets, which is draining badly-needed supply from the rental market. A 31-day minimum stay requirement included in the scheme's terms would remedy this.

While there isn't enough rented accommodation to go around - a factor that is keeping rents high - there are an estimated 28 million empty bedrooms in England, Wales and Scotland which could be repurposed to boost rental stock4. While not everyone is in a position to rent those out, freeing up just 5% of those rooms would provide affordable accommodation for 1.4M people.

Matt Hutchinson, director of flatshare site SpareRoom.co.uk, comments:

“People rent out rooms in their homes for all sorts of reasons - financial, practical, and social - and in doing so they inject desperately-needed supply into the UK room rental market which is suffering under the weight of intense demand that's inflating rents.

“The original intention of the Rent a Room scheme was to increase the quantity and variety of low-cost rented housing. However, because the scheme doesn't stipulate a minimum length of stay, in recent times it has also been used by those renting out furnished rooms to holidaymakers on sites like Airbnb. It's time this loophole was closed so the scheme can help renters as intended.

“We also want to see the scheme's threshold increased to reflect rents today. Tax lost to the public purse by raising the threshold could be recouped by taxing holiday lets.

“We have a housing crisis, not a hotel room crisis. We have to disincentivise anything that takes away supply from our already under-served rental market and stops people from living well. Rental supply needs a shot in the arm and tweaking the Rent a Room scheme is a glaringly obvious fix. In the midst of a housing crisis, protecting affordable supply is critical.”