The pandemic had a chaotic and lasting impact on the UK rental market. After restrictions on movement were finally lifted from mid 2021 there was a rush to secure rented accommodation. Demand for rooms hit record highs, with more than eight people on average searching per room available to rent across the UK, and more in the most popular areas. Today, renters are still paying the price for this post-pandemic frenzy, reports flatshare site SpareRoom.

Record demand forced up rents

The graph below shows the number of people searching for rented accommodation per room available to rent between 2019-2022. It shows a huge surge in people looking for rooms as pent-up demand re-entered the market in 2021.

In England, the vast majority of restrictions were lifted in July 2021. In Scotland, the legal requirements for physical distancing and limits on gatherings were removed in September 2021 and in March 2022 all travel restrictions were removed. Wales moved to 'alert level zero' in August 2021 when all restrictions on meeting with others were removed and all businesses were able to re-open. The effect this had on demand in the rental market can be seen clearly in the graph.

Demand has cooled, but rents haven't

Fast-forward to 2025, and the market is finally showing signs of stabilisation. Renter demand has cooled, and supply has started to improve, as illustrated in the graph below, which shows the number of people searching per room available between 2022 and the present day. It looks very different to the previous graph.

But here's the thing. Although demand has subsided to normal levels, rents have never corrected to their pre-pandemic levels. They hit record highs, and they've stayed high - not just in London but in every major town and city in the UK.

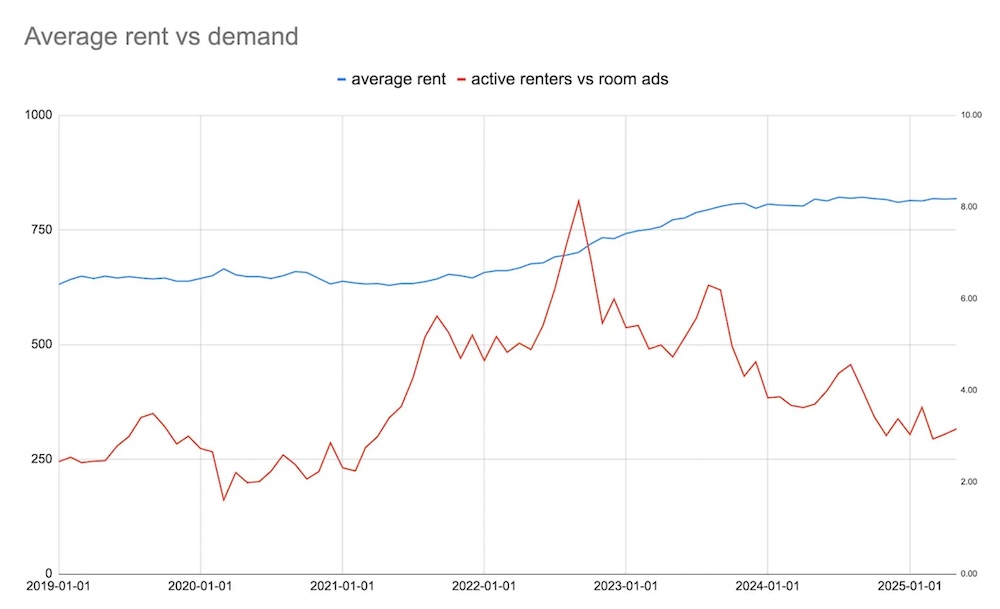

The graph below shows that, despite huge changes in the ratio of renters to rooms available (shown in red) between 2019-2025, rents (shown in blue) only went in one direction1.

And as long as demand continues to outstrip supply, that won't change. Fears around a landlord exodus prompted by the Renters' Rights Bill, which could reduce supply still further, are growing.

Flatlining rents are masking an affordability crisis

The table below shows how average UK room rents have changed over the past two years. Rents now appear to be relatively stable and there have even been some marginal quarterly decreases in London average rents2.

| Quarter | Average monthly room rent whole of UK | Average monthly room rent UK (excl. London) | Average monthly room rent London |

|---|---|---|---|

| Q2 2025 | £747 | £665 | £980 |

| Q1 2025 | £746 | £665 | £982 |

| Q4 2024 | £746 | £664 | £993 |

| Q3 2024 | £747 | £663 | £995 |

| Q2 2024 | £741 | £658 | £983 |

| Q1 2024 | £741 | £655 | £996 |

| Q4 2023 | £740 | £650 | £1,015 |

| Q3 2023 | £722 | £633 | £990 |

| Q2 2023 | £705 | £617 | £973 |

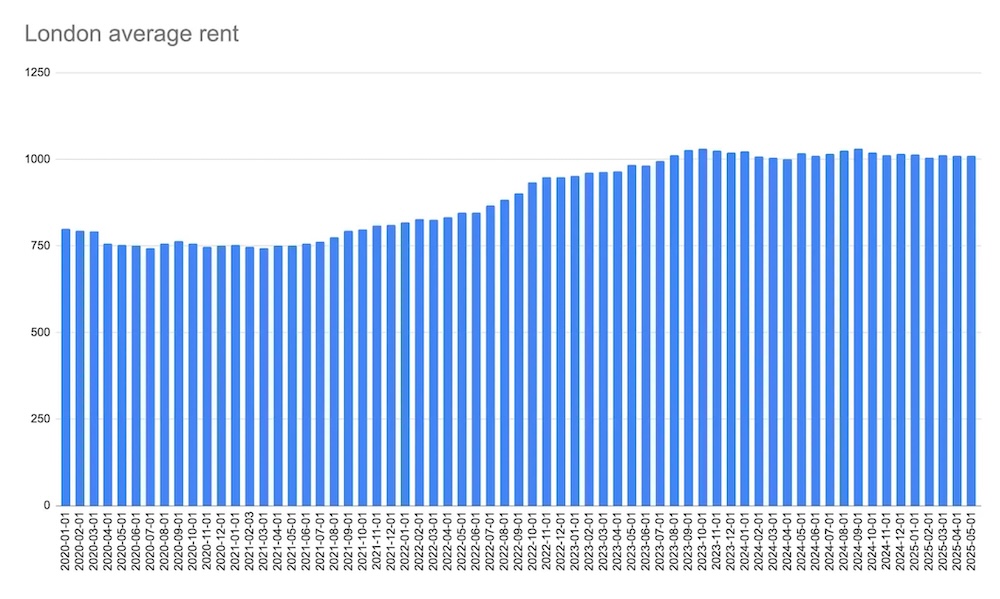

However, zoom out and view the rental market over years, not months, and you'll see that it is still trending upwards, as shown in the UK and London graphs, charting rents, below. Falling doesn't mean affordable, and what we never see are sustained decreases taking rents down to levels deemed affordable, i.e. below 30% of income.

Rents are no longer affordable, even for flatsharers

Take London rents as an example. While slightly lower than their late-2023 peak, they still remain close to £1,000 per month. Almost half (49%) of London flatsharers now consider their rent to be unaffordable3.

Sharing is the most affordable way to rent and yet even flatsharers have reached their affordability ceiling, so much so they are being priced further out of cities and into suburbia, market towns and villages4.

Wage increases have never kept pace with rent rises or the spiralling cost of living, so the affordability gap gets ever wider.

A March 2025 survey by SpareRoom of 6,524 flatsharers found three quarters are now spending more than 30% of their take-home pay on rent, and 26% are spending more than half. More than four in 10 (42%) UK renters consider their rent to be unaffordable5.

In London, the affordability issue is considerably worse with eight in 10 spending more than 30% of their pay on rent and 28% spending more than half.

Matt Hutchinson, director of flatshare site SpareRoom, comments: “Rents may be flatlining now but that isn't being felt by renters who are really struggling to meet the day-to-day costs of living. We hear from far too many people who are having to make significant changes to their living arrangements - sharing with more people, or living further away from the city and their place of work - to make sure there's enough money left to live on after they've covered their rent. Something has to give. All efforts now need to be on policy that boosts rental supply in meaningful quantities.”