It's no secret that the UK is currently suffering from a rental crisis, and it's affecting all involved.

Demand for rental properties has soared, yet supply is falling. Combine that with high inflation and rising interest rates and it means record high rents. Renters are struggling, and landlords are leaving the market.

So the question is - what can be done about it?

As the UK's leading flatshare site, SpareRoom has a unique insight into trends in renting amongst agents, landlords, homeowners and tenants. We've been running flatshare sites for over two decades and have never seen the market as imbalanced as it's been over the past 18 months!

So, we've laid out the key facts that contributed to this imbalance in the market, and our plan to help change things for the better. They are things the government could do easily and quickly and will help for years to come, while they work out how to build the homes we need.

How it happened and what's going on

1. The rising cost of private renting

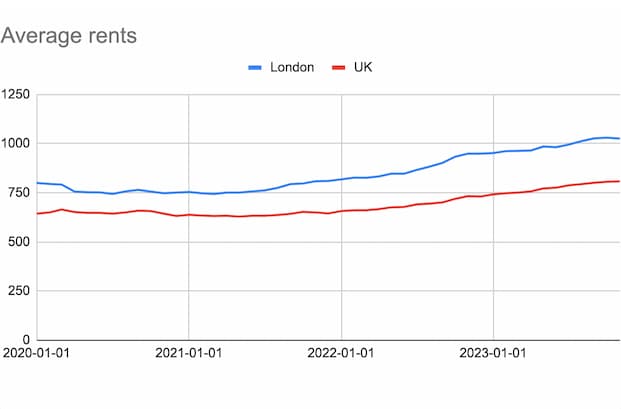

SpareRoom data shows that room rents reached an all-time high in the third quarter of 2023, with the average UK room rent increasing by 16% to £721 a month, compared to the same time the previous year. The average cost to rent a room in Greater London reached £989 a month - a 16% increase on the previous year.

And these are just the average rents for one room in a shared house.

2. The rising demand for room renting

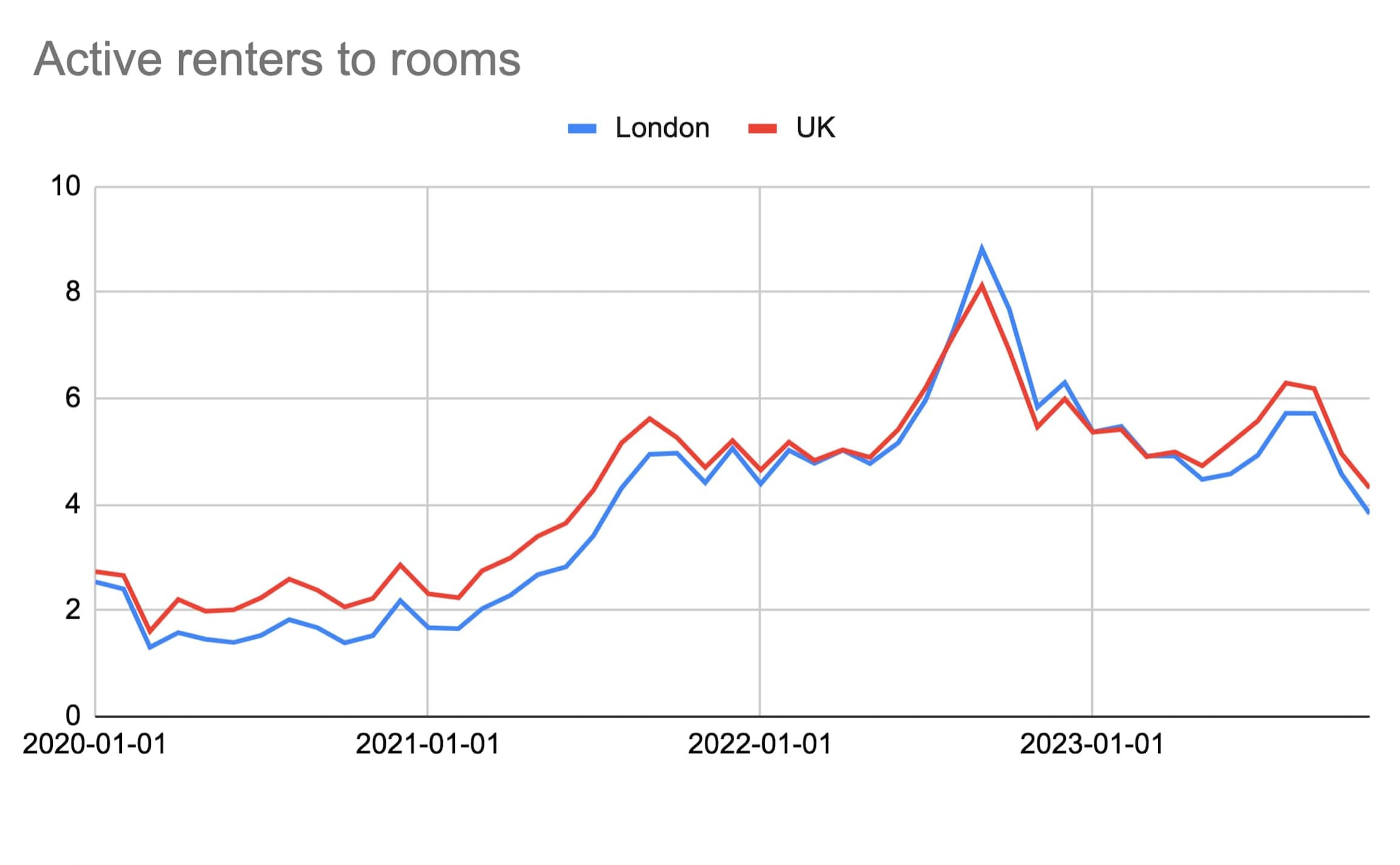

SpareRoom's data shows that there has been a consistent decline in the number of rooms being advertised in recent years, from peaks of almost 65,000 ads on SpareRoom in January 2017 to just 35,668 by September 2023. That's almost half in the space of 6 years.

Meanwhile, the number of people in the UK actively looking to rent via SpareRoom has almost tripled over the past decade, from 70,838 in January 2013 to 227,148 in September 2023. The number of people looking to rent in London increased from 33,673 in January 2013 to 91,015 in September 2023.

The average number of views per room ad has also almost doubled, from just under 300 between January 2013 and December 2020, to 550 views per ad since January 2021. Ads were reaching as high as 949 views in September 2022.

3. Potential spare room capacity

The ONS Census 2021 shows there are at least 26 million spare bedrooms in England and Wales alone. Scotland's 2011 Census found 2.5 million spare rooms.

If even a small proportion of homeowners were to rent out a spare room, this could unlock tens or hundreds of thousands more rooms for renters. This would, in theory, begin to rebalance the supply vs demand in the rental market. In simple terms - the loss of existing rooms to short-term lets would be offset, and rent prices would (hopefully) drop.

The Rent a Room Scheme, and why it's important

The Rent a Room Scheme, introduced in 1992, provides a financial incentive for owner-occupiers and private renters to offer a spare room for rent.

It currently allows individuals to earn up to £7,500 tax free from letting out furnished accommodation in their main or only residence, provided they also live in the property.

The tax relief threshold was initially set at £3,250 in 1992 and increased to £4,250 in 1997. In April 2016, it was raised to £7,500 following SpareRoom's Raise the Roof campaign, supported by Shelter, Generation Rent and the National Landlords Association.

In 2016, just 21% of rooms advertised on SpareRoom were above £625 a month (£7,500 a year), and in 2021 still only 26% were above that level.

But rapid rent increases in the past two years have pushed the proportion of room rents above the tax relief threshold up to 33% in 2022 and to 49.3% in 2023, pushing thousands of homeowners into tax who had previously been exempt. Having to fill out a self assessment tax return to be able to rent out a room puts people off.

With rents rapidly rising, if Rent a Room relief were restored to its 2016 level, it would be equivalent to £9,835 (at September 2023 prices). At this level, 80% of room rents would again be below the tax relief threshold.

Landlords are shifting to short term lets

Landlords of residential properties in the long-term rental market don't benefit from several key tax reliefs offered to short-term let landlords. This has led to many landlords quitting the market altogether, or switching to providing short-term lets instead.

Mortgage interest relief for residential landlords is restricted to the 20% basic rate of income tax, while furnished short-term let landlords can claim the full mortgage interest as an expense.

Here's what else short-term (holiday) let landlords can claim:

- Capital allowances on holiday lets that typical buy-to-let landlords can't, including the cost of refurbishing or upgrading the property, plus furniture, fixtures and equipment to kit out the property to a high standard

- Capital Gains Tax Business Asset Rollover Relief and Entrepreneurs' Relief on the sale of their properties

- Landlords of self-catered holiday lets can also switch from paying council tax to business rates and then claim exemption: landlords who only rent out one property and whose annual business rates bill is less than £12,000 are exempt and will pay no tax at all

SpareRoom believes that reliefs such as these are encouraging the growth of short-term lets at the expense of long-term rentals.

A 2023 VisitBritain report found that the number of short-term rental properties in the UK has grown by 20% over the past four years, from around 365,000 in January 2019 (pre-Covid pandemic) to almost 405,000 in January 2023. These are properties that are therefore not available for long-term lettings.

What SpareRoom is doing about it

At SpareRoom, we connect renters with places to rent, and landlords/agents with renters . Because we can't physically create more rental properties, we have little influence on the market itself. However as the number 1 flatshare site in the UK, representing millions of renters, landlords and homeowners, we definitely have a platform to influence the people who can create more supply. The market is in crisis and we want your voices to be heard, which is why we've put together a detailed briefing document on the current rental crisis. This includes in-depth data from SpareRoom, alongside stats from government sources and beyond. It explains the key supply and demand issues, how we got here and, crucially, what we think the government can do to fix things.

We've sent the report to hundreds of MPs, political advisers, journalists, housing charities and think tanks and are requesting their support for two things.

What we're campaigning for

1. Raising the Rent a Room Scheme threshold

We think it's time to restore the real value of the Rent a Room Scheme to encourage more homeowners to rent out their rooms. With literally millions of rooms sitting empty, this will help with supply, while also helping homeowners cope with huge increases in mortgage interest rates.

We're asking the Treasury to set the threshold at £9,795 in the next Budget. We believe it would also be beneficial to restrict use of the Rent a Room Scheme to people offering rooms to long term lodgers, rather than as short term or holiday lets, in keeping with the scheme's original intent to create more residential supply.

2. Level the tax playing field to encourage more residential lets

We're also asking the Treasury to review the range of tax reliefs offered to the long-term rented and short-term rented sectors. The aim is to level the tax playing field between them and remove the factors that encourage buy-to-let landlords to switch from providing long-term homes to holiday lets.

We're not asking for additional tax reliefs, simply that those available to holiday let landlords are also available to people offering residential properties. To put it simply, we have a housing crisis, not a hotel room crisis, so we need to stop prioritising short term lets over homes.