People who rent out furnished rooms in their homes to lodgers can currently earn up to £7,500 per year - equivalent to £625 per month - tax free under the Rent a Room scheme.

However, that tax-free threshold has not been increased since April 2016 and is no longer representative of room rents today.

Flatshare site SpareRoom, which successfully campaigned for the threshold to be raised 10 years ago, is calling on the Government to revise the threshold upwards and, in doing so, boost supply in the rental market.

1. Boost the supply of affordable rented accommodation

It's not just twenty-somethings who can't afford to buy or rent alone, the number of people flatsharing in their 40s and 50s is also increasing. Flatsharing is the most affordable way to rent but, with demand outpacing supply, even this is now out of reach for too many.

Spending less than 30% of income on rent is deemed affordable, yet three quarters of UK flatsharers now spend more than 30% of their take-home pay on rent. And those spending more than half their pay on rent is creeping up - from 24% in 2021 to 26% in 2025.

Under 25s, who have not yet reached their earning potential, are feeling the pinch most, with 40% spending more than half their take-home pay on rent.

| Q. What % of your monthly take-home pay goes on rent? |

UK flatsharers |

|---|---|

| Less than 20% | 7.4% |

| 20-29% | 17.8% |

| 30-39% | 27.7% |

| 40-49% | 21.1% |

| 50-59% | 13.6% |

| 60-69% | 6.7% |

| 70% or more | 5.8% |

Source: SpareRoom survey of 6,524 UK flatsharers March 2025

There's no way to build fast enough to keep up with demand, so efficient use of existing stock is vital. There are an estimated 28 million empty bedrooms in England, Wales and Scotland1.

While not everyone is in a position to rent those out, freeing up just 5% of those rooms would provide affordable accommodation for 1.4M people.

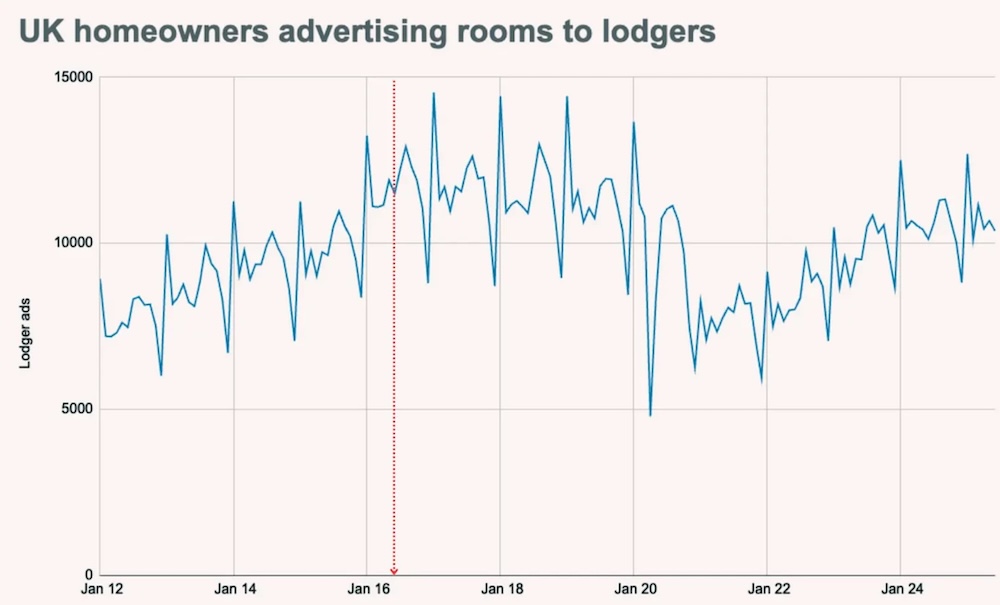

SpareRoom has evidence that increasing the tax-free threshold again would encourage more spare rooms to be rented, based on what happened when it was last raised in April 2016.

The graph below shows the number of ads placed by homeowners renting out rooms to lodgers since 2012. January 2017 was the highest month on record for homeowners offering rooms to lodgers. The numbers spiked and remained high after the threshold was increased, and then dropped dramatically during the pandemic. The red line marks when the threshold increased to £7,500 in April 2016 having been announced the previous year.

In July 2025, SpareRoom surveyed former lodger landlords and people who had expressed an interest in becoming lodger landlords but who weren't currently renting out rooms:

- 83% said they would be more likely to rent out a room if the tax-free threshold was higher than £7,500 per year.

- 40% said they'd stopped renting out a room because their earnings would take them over the tax-free limit and they would have to complete a tax return2.

2. Help for cash-strapped homeowners

The Rent a Room Scheme threshold has remained unchanged since 2016. Today, more than six in 10 (62%) UK postcode districts have rents higher than £625 per month. The average UK room rent is well above this now, at £748 per month including bills, and £980 per month in London.

In 2016 only London was above the £7,500 threshold; nowhere else was close. But, in 2025, there are 16 towns and cities above the threshold, including Edinburgh, Bristol, Brighton, Oxford, Cambridge, Manchester and Cardiff.

Encouraging people to take in lodgers could help them avoid debt or repossession when interest rates rise and mortgage repayments are adjusted.

3. Cheaper rents

Being a lodger, rather than a tenant, can save people money. Lodging is on average 11% cheaper than renting from a regular landlord or via a lettings agent, and 17% cheaper in London.

What should the new threshold be?

If the allowance had risen with inflation the threshold would now be close to £11,600 per year3. If the threshold was increased to £11,600 per year, average rents in 94% of UK postcode districts would fall below the tax relief threshold4.

Between Q2 2016 and Q2 2025, average room rents in the UK increased by 21% and rose by 34% in London.

In Ireland, a similar scheme lets people earn up to €14,000 per year tax-free if they rent out a room in their home. This amount covers rent as well as things like food, utilities, laundry and other services.

What should the terms include?

Currently, the Rent a Room scheme can be used by anyone renting out a furnished room in their home. This includes people offering rooms for short-term holiday lets. Ireland's scheme states that rooms must be rented on a long-term basis. This stipulation prevents people from offering holiday lets - which are not needed - and boosts desperately-needed rental supply instead. We'd like to see a 31-day minimum stay included in the scheme's terms.

The UK has a housing crisis, not a hotel room crisis. We need to incentivise more homeowners to contribute to rental stock.

Matt Hutchinson, director of flatshare site SpareRoom, comments: “Shared living is an integral part of the UK's housing landscape, yet unprecedented rent hikes post-pandemic have pushed thousands of homeowners into tax who would usually be eligible for Rent a Room relief, putting them off renting out rooms.

“Incentivising more homeowners to rent out their empty bedrooms is a win-win, provided they are for lodgers, not holidaymakers. Increasing rental supply has knock-on effects for affordability while helping homeowners to meet the rising cost of living. We also think the Government should commit to reviewing the threshold annually, not every 10+ years.”