In 2025, UK room rents hit record highs of £753 per month in Q3. In 2026, tenants will benefit from new protections from eviction with the phasing in of the Renters' Rights Act, but are still vulnerable to market volatility and rising rents. And supply remains under threat amid low confidence among landlords, reports flatshare site SpareRoom.

Rent rises

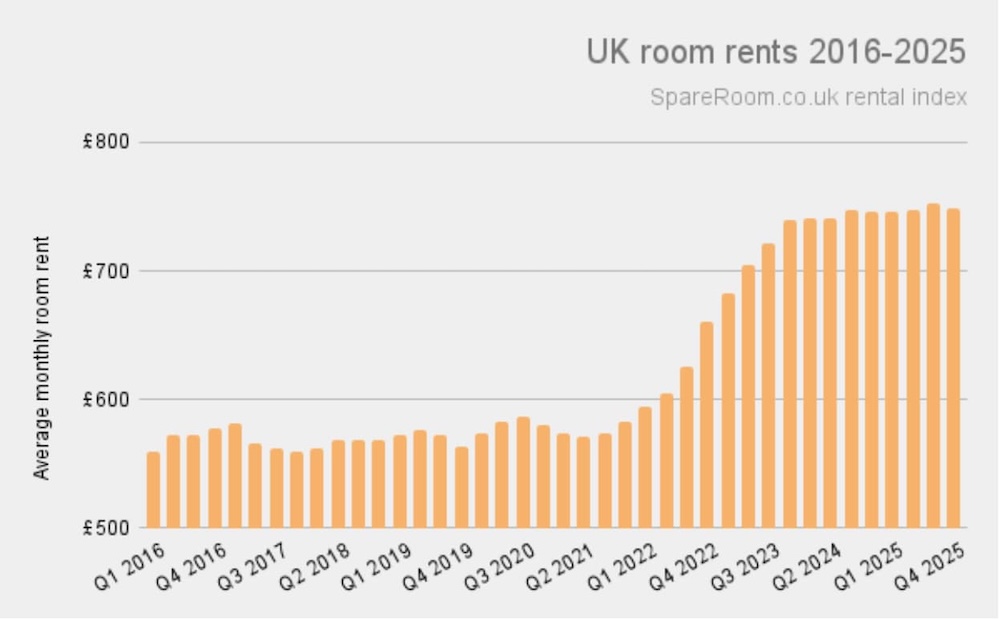

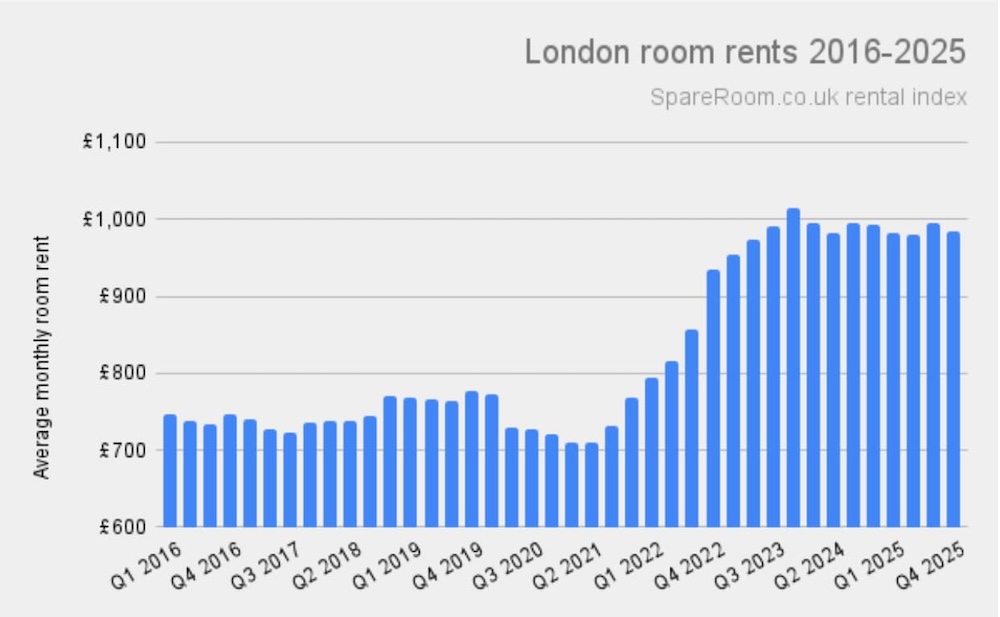

After years of pressure on the rental market - the prolonged hangover of a record spike in demand after the pandemic, which forced up UK average rents by 34% and London rents by 38% in just four years1 - rent rises were subdued throughout 2025.

Nationwide, renters saw marginal year-on-year average increases of less than 1% in each quarter while London renters saw some marginal decreases as demand returned to pre-pandemic levels. But what renters need most - for rents to drop to affordable levels - hasn't happened. In fact, the UK average rent hit a record high of £753 per month in Q3 2025.

The tables below show what room rents have been doing throughout 2025:

Whole of UK

| Quarter | Average monthly room rent |

Year-on-year rent change |

5-year rent change |

|---|---|---|---|

| Q4 2025 | £749 | 0.5% | 29.0% |

| Q3 2025 | £753* | 0.8% | 28.3% |

| Q2 2025 | £747 | 0.9% | 28.3% |

| Q1 2025 | £746 | 0.7% | 29.9% |

Source: SpareRoom quarterly rental index (*highest figure on record)

Inner London

| Quarter | Average monthly room rent |

Year-on-year rent change |

5-year rent change |

|---|---|---|---|

| Q4 2025 | £985 | -0.9% | 36.6% |

| Q3 2025 | £995 | -0.1% | 36.7% |

| Q2 2025 | £980 | -0.3% | 34.2% |

| Q1 2025 | £982 | -1.4% | 27.1% |

Source: SpareRoom quarterly rental index

Renter demand

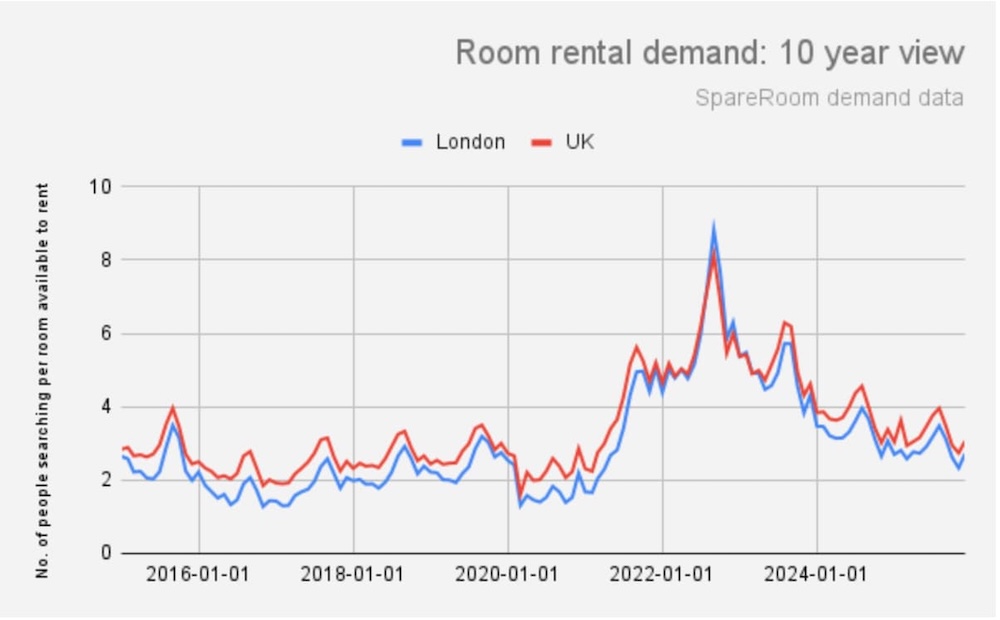

The table below shows a 10-year view of demand in the flatshare market, based on the number of people searching for rooms available to rent. Demand spiked after pandemic restrictions ended and is only just returning to levels seen before Covid-19.

Affordability crisis

Flatsharing is the most affordable way to rent and yet, with average rents hitting record highs in 2025, too many renters are now spending 40% or even 50% of their income on rent. This can delay life plans and push people into debt.

Based on the '30% rule', which is the maximum recommended proportion of income spent on housing costs, flatsharing is only affordable for those earning at least £30,120. To live in a London postcode, renters must earn at least £39,804 to make it affordable (source).

The lack of affordable rented homes has knock-on effects for the economy which relies on a flexible workforce. Sky-high rents are fuelling a trend called 'flathugging'. More than half (56%) of UK renters are staying put in their current rental properties despite wanting to move, with almost three quarters citing available housing being out of budget as a reason (source).

The two graphs below show the dramatic impact of the pandemic on rents in the UK and London. Lockdowns and restrictions started to lift in mid 2021, and rents began to soar:

Rental supply

Room rental supply is still in growth, but may be showing early signs of slowing down.

The total number of flatshare ads grew by 4.1% between 2024 and 2025, compared to 17.7% growth between 2023 and 2024.

Interestingly, the slowdown in ad growth was most pronounced among lodger landlords who rent out rooms in their own homes, and whose ads make up a quarter of all rooms available to rent. Updating the Rent a Room scheme's tax-free threshold, which hasn't changed since 2016, would help boost rental market supply (source).

At the same time, confidence among landlords navigating the introduction of new rules in the Renters' Rights Act is low and, in an October 2025 survey of landlords using SpareRoom, 27% claimed they were in the process of leaving the rental market while 5% were moving into holiday lets or short-term lets, a potentially huge problem for the already under-supplied rental market (source).

While it's too early to tell whether this is a trend, SpareRoom will continue to monitor and report on rental market supply in 2026.

Matt Hutchinson, director of flatshare site SpareRoom, comments: “No one could have predicted the impact of the pandemic on rents, but here we are, and renters are still at the mercy of market volatility. Flatlining rents in 2025 don't help the tenant who goes into the red every month because they're paying half their salary to their landlord, and can't find anything more affordable. And as long as demand outweighs supply, rents won't fall.

“It's a crisis that's pushing more flatsharers out of cities. Zoom in on suburbia, where renters must weigh up slightly more affordable rents against more expensive commutes, and rents are rising faster than average, fuelled by intense demand.

“On the upside, supply is still growing, but that could change in 2026 once the Renters' Rights Act is phased in from 1 May. Despite better protections, tenants are in a vulnerable place as landlords weigh up their investments. Smaller landlords are still a flight risk and it's likely we'll see a move towards professional landlords dominating the market in the coming years.

“With supply under threat in 2026, the Government needs to recognise the critical role lodger landlords play in alleviating the housing crisis. They contribute a quarter of total supply to the flatshare market, helping balance demand and supply and curbing rent rises. Smart tweaks to the Rent a Room scheme would encourage more people to rent out some of the estimated 28 million empty bedrooms in England, Wales and Scotland to lodgers. Closing the loophole that allows holiday lets to use the scheme would divert supply into the rental market, as would raising the tax-free threshold to reflect rents today, not in 2016 when it was last updated.”